Voices is a registered 501c3 non-profit incorporation and all donations to Voices are tax-deductible. The best way to let Voices know you appreciate our efforts is with a donation!

You can help Voices and express your support by making a quick and easy PAYPAL donation with this button.

You don't need a PAYPAL account, but maybe it's time to start one? Thank you so much for helping.

You can print out your confirmation email from Paypal as your donation receipt for tax purposes. Or contact us to receive a receipt if you need one.

If you would prefer to mail us a check, that would be wonderful. Make the check payable to "Voices of Central Pa" and mail it to:

VOICES of Central Pennsylvania

PO Box 296

State College PA 16804

We can also accept donations of appreciated stock, which is a great way to maximize the power of your donation while at the same time maximizing your tax benefits.

Benefits of Donating Stock.

A gift of stock may be donated at its current full fair market value. This means the donor receives a charitable income tax deduction credit based upon the stock's current full fair market value, not the purchase price. The donor bypasses paying the capital gains tax due and maximizes their gift. In addition, the stock donor may deduct up to 30% of their adjusted gross income (AGI) in the year of the gift, with a five-year carry over for any unused portion of the deduction.

For example, you have a stock which you purchased at $15.35 a share, it is now valued at 48.50 a share; the $33.14 gain per share on this stock would be subject to federal capital gains taxation if you sold it.

How to Donate Stock.

To receive a charitable income tax deduction the gift of stock must be transferred directly to Voices, a 501 (c) (3) non-profit organization. Do not sell it!

Contact us at [email protected] to arrange for such a donation. Thank you!

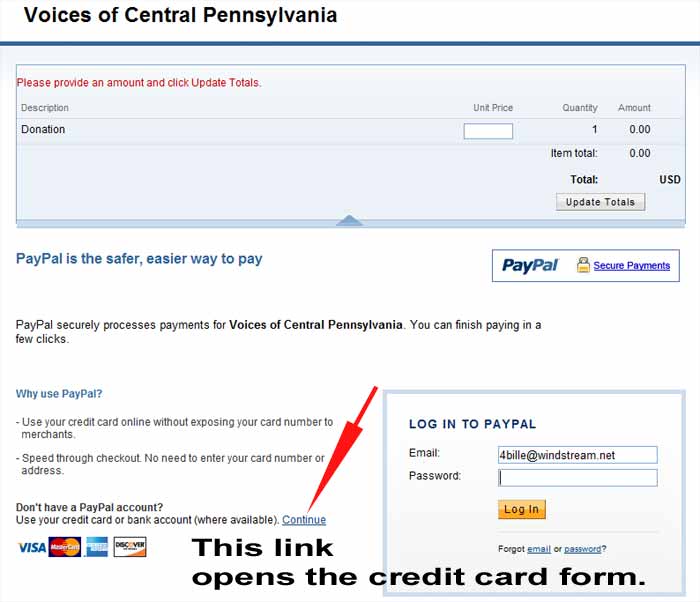

Having trouble finding a way to donate with paypal if you don't have an account? Sometimes paypal hides the link a bit. The red arrow points to the link you use to open a secure credit card form.